Acquiring a business aircraft is a strategic decision that demands a clear understanding of the financial commitment involved. However, many new owners underestimate the true cost of ownership, leading to budget overruns and unexpected expenses. For those exploring business aircraft sales, avoiding these common budgeting mistakes is crucial for a smooth and successful ownership experience.

MISTAKE 1: UNDERESTIMATING FUEL COSTS

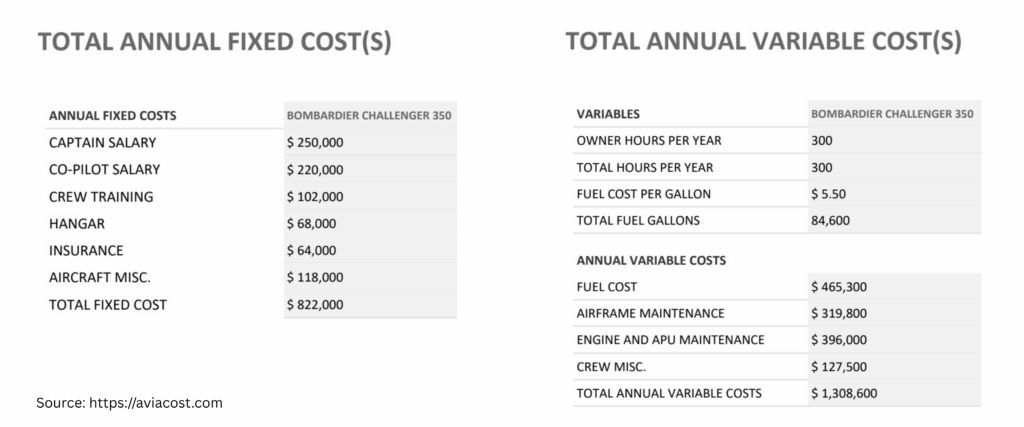

While fuel is a predictable variable cost, its price and consumption can catch new owners off guard. Fuel prices are volatile, and an aircraft’s fuel burn varies based on factors like flight altitude, aircraft weight, and weather conditions.

How to avoid it:

- Create a realistic fuel budget: Consult with a broker or aircraft management company to get an accurate estimate of fuel burn for your specific used corporate plane.

- Factor in Price Fluctuations: Don’t just budget for the current price per gallon. Anticipate and set aside funds for potential price increases.

- Optimize Flight Planning: Work with your pilots to create the most fuel-efficient flight plans.

MISTAKE 2: NEGLECTING MAINTENANCE RESERVES

Maintenance is often the most significant and unpredictable expense of aircraft ownership. Many owners make the mistake of not setting aside adequate funds for future, large-scale maintenance events.

How to avoid it:

- Budget for Hourly Maintenance Reserves: Calculate and budget for hourly reserves for major components like engines, APU, scheduled inspections and unscheduled maintenance and landing gear. This helps smooth out the cost of major overhauls.

- Understand Maintenance Programs: If your aircraft is on a maintenance program, understand the monthly or hourly fees and what they cover. Many programs have minimum annual utilization clauses that you must pay regardless of your flight hours. Often the costs for the programs increase over time, so be sure to account for program cost escalations.

- Plan for Airworthiness Directives (ADs): The FAA can issue ADs that require mandatory, recurring inspections or parts replacements. These can add significant, unplanned costs.

MISTAKE 3: OVERLOOKING FIXED COSTS

These costs don’t change based on how much you fly, and they can add up quickly.

Common oversights include:

- Insurance: Premiums can be substantial, and they often increase if a pilot’s experience or training lapses.

- Hangar Fees: Costs vary significantly based on location and aircraft size. They are a fixed, non-negotiable expense.

- Crew Salaries and Training: Don’t forget to budget for annual salaries, benefits, and regular, recurrent training, which is mandatory and expensive.

- Management Fees: If you use a management company, their fees can range from tens to hundreds of thousands of dollars annually.

How to avoid it:

- Create a Detailed Annual Budget: Work with a trusted and experienced IADA accredited broker to create a comprehensive list of all fixed costs, including insurance, hangar fees, and crew-related expenses.

MISTAKE 4: NOT PLANNING FOR MARKET DEPRECIATION

Aircraft values generally depreciate over time, and failing to account for this can lead to a significant financial loss when it’s time to sell.

How to avoid it:

- Factor in Depreciation: Consult with a trusted and experienced IADA accredited broker to get a realistic estimate of the aircraft’s annual depreciation.

- Plan Your Exit Strategy: If you plan to sell the aircraft in a few years, factor in the depreciation when you set your budget. Be sure to look at major inspections to know how that will potentially impact the value of the aircraft when you want to sell.

MISTAKE 5: POOR RECORD-KEEPING

Accurate and complete records are essential for both tax purposes and for maximizing the resale value of your aircraft. Many owners fail to keep meticulous records of flight times, maintenance, and expenses.

How to avoid it:

- Implement a Digital Logbook and Maintenance Tracking System: Cloud-based logbook systems simplify record-keeping and make it easy to access information for tax purposes or for a prospective buyer. Digital maintenance tracking systems are also critical and make selling the aircraft much smoother.

- Document Everything: Keep a detailed record of every flight, maintenance event, and expense. This also helps with substantiating business use for tax purposes.

THE BOTTOM LINE: BUDGETING FOR YOUR BUSINESS AIRCRAFT

Whether you’re in the final stages of a business aircraft transaction or just beginning your search, avoiding these common budgeting mistakes is paramount. A clear and accurate understanding of both variable and fixed costs ensures that owning a business aircraft remains a strategic asset that enhances your business, rather than an unexpected financial burden.

At Holstein Aviation, our IADA certified professionals bring decades of transaction experience, real-time market intelligence and global reach. We guide our clients through every step of the process, ensuring confidence and clarity in today’s dynamic environment. Understanding the budget for a business aircraft is a very critical piece of the equation, and the Holstein team will ensure you are fully equipped with the knowledge necessary to make excellent decisions. If you’re preparing to buy and aircraft or sell your aircraft, Holstein Aviation is your trusted partner in business aviation.